Here’s the question I received recently:

“I’m getting married soon, and my fiancé and I have always had separate bank accounts. We both have our own savings and our own debts. I support my parents sometimes, and he does too. I think he’s expecting us to combine finances after the wedding, but I’m not sure how to navigate this. I want us to be open, but I also don’t want to lose my financial independence. How do I approach this without making it a big fight?”

From “Mine” to “Ours”: The Transition That No One Really Talks About

There’s something deeply intimate about merging money. It’s not just numbers in a bank account — it’s about trust, shared responsibility, and the unspoken message: we’re in this together now.

For many of us, especially if we’ve lived independently or maintained our own accounts for years, the idea of going from “my money” to “our money” feels like a shift in identity. It’s no longer just your rent, your Netflix subscription, your grocery list — suddenly it’s our bills, our debt, our savings.

And here’s where life situations make a difference:

- If you’re moving in with his parents, the financial responsibilities might look different. Your contributions could shift toward savings, helping with family expenses, or supporting extended family.

- If you’re getting your own place together, you’re navigating rent or mortgage, utilities, groceries — the “adult life starter pack” — right from the start.

Both scenarios carry their own pressure points. And both require more than just “we’ll figure it out.”

Cultural Layers: How South Asians View Money

In many South Asian families, money isn’t just personal — it’s collective. There’s an unspoken understanding that financial stability is shared, and that children will help parents or extended family when needed. Supporting siblings through school, helping parents with bills, contributing to weddings — these aren’t “extra” expenses; they’re woven into family life.

This cultural context can make money conversations in marriage more layered. You’re not just talking about how you and your partner spend; you’re navigating how to balance your shared life with ongoing commitments to your families.

The Fear of Losing Independence

Even if you love your partner deeply, money is one area where independence can feel non-negotiable. Having your own account means you can buy what you want without explaining, save at your own pace, and have a safety net that’s truly yours.

The fear many people have — but don’t always voice — is:

- Will I have to justify every purchase?

- Will my financial decisions still be respected?

- If something goes wrong, will I still have access to my own resources?

These aren’t selfish questions. They’re human ones.

Talking About the Numbers (Without Making It a Fight)

Money talks can quickly get defensive because finances often carry shame, guilt, or pride. But transparency is essential — not just about what’s in your accounts now, but also about your debt, your savings habits, and your future financial commitments.

Some guiding questions for the conversation:

- How much debt are we each carrying, and what’s our plan for paying it off?

- How much do we each have in savings, and what’s that money earmarked for?

- What financial commitments do we have to our families, and how will that fit into our shared budget?

- What are our shared goals — a home, travel, kids, investments — and how will we work toward them?

- Do we want a joint account, separate accounts, or a mix of both?

This isn’t about interrogating each other — it’s about putting the full picture on the table so you can make decisions from a place of honesty.

Why These Conversations Are Hard Before Marriage (and Why They Matter)

Money touches almost every decision in married life — where you live, what lifestyle you can afford, whether you can take risks or travel. But because it’s so loaded, many couples avoid it until they have to talk about it.

The truth is, discussing money early helps you:

- Avoid resentment later.

- Understand each other’s priorities and fears.

- Build trust by being open about a vulnerable topic.

How to Talk to Your Partner About Money Without Triggering Defensiveness

- Pick the right time — Not during a heated argument or when one of you is stressed.

- Start with shared goals — “I want us to be on the same page so we can feel secure together.”

- Own your feelings — Use “I” statements instead of “You” accusations.

- Be willing to listen — Money habits often come from upbringing, and they may be deeply ingrained.

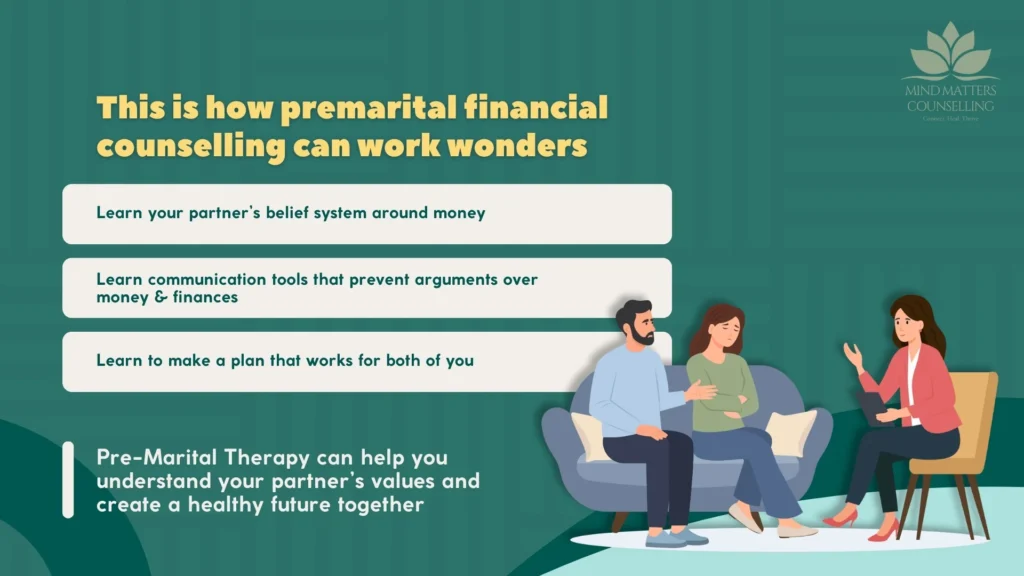

Why Financial Therapy or Premarital Counselling Can Help

Sometimes, money conversations need a neutral space. A therapist or financial counsellor can help you:

- Unpack the emotions and beliefs you’ve each learned about money.

- Create a plan that respects both your independence and your shared future.

- Learn communication tools that prevent money talks from becoming fights.

Premarital counselling isn’t just for couples with “big problems” — it’s for couples who want to build a foundation that lasts. And in my experience, talking about money early is one of the most loving things you can do for your future together.

If you’d like to support navigating these conversations before your wedding, book a session with Mind Matters Counselling — we can help you explore the emotional, cultural, and practical layers of money and marriage.